The Education Department projected that student loans would generate $114 billion in income over the last 25 years. However, a new report shows that federal student loans have actually cost the government $197 billion, a $311 billion difference.

The findings come from a Government Accountability Office report released today that undermines a narrative from the department that the federal student loan program is generating income. The study, analyzing data on student loans between 1994 and 2021, found that the Education Department greatly underestimated how changes to loan programs and borrower behavior have impacted the federal student loan balance.

Recent changes to the loan program since the start of 2022 that were not included in the study, like the Public Service Loan Forgiveness (PSLF) waiver and multiple group discharges of federal student loan debt, will drive the cost higher. Additionally, if President Biden moves to cancel some outstanding student debt, the cost would rise as well.

The shift, according to the report, is driven by changes to the federal student loan program, as well as flawed assumptions about borrowers’ income, repayment rates and default.

Although the GAO did not offer recommendations for the department to improve its budgeting method, the report highlights key factors for review that are contributing to massive differences in how much the student loan program is actually costing taxpayers.

In a letter to the GAO in response to the report, Under Secretary of Education James Kvaal said, “In some cases, estimates are revised because of changes in both the data available to the department and the department’s methodology for estimating costs.” He continued, “While the department always strives for the best possible estimates, there is some inherent uncertainty in the department’s cost estimates, which the department publicly discloses in its Agency Financial Report and the President’s Budget.”

The findings of the report have sparked harsh pushback from congressional Republicans, who have been highly critical of the Biden administration’s changes to the student loan system (although the report covers years that Republicans were in charge of the government as well as Democrats). “Any way you look at it, the claim that the federal government ‘profits’ off student loan borrowers is false. Taxpayers have lost hundreds of billions of dollars on this program,” said a statement from a group of Republican lawmakers from both the House of Representatives and the Senate.

What Is Causing the Difference?Every year the Education Department submits an estimate of its costs for the purposes of developing the federal government’s annual budget. This includes estimates for any new loan programs as well as loan performance, such as how many borrowers are expected to default or how much outstanding debt will be paid off.

The department, however, cannot fully realize the true cost of the federal student loan program until the loans are fully paid off. Therefore, it must estimate how fast borrowers will pay back their debt, how many borrowers are expected to default and how borrowers’ incomes might change in a given year. The report found that since 1994, not a single group of borrowers has completely paid off its debts.

As a result, the Education Department’s estimates are often far off from what actually occurs in a given year, the study finds. Inevitably, certain social and economic changes, such as a recession or a pandemic, are not always able to be accurately forecast at the beginning of a fiscal year.

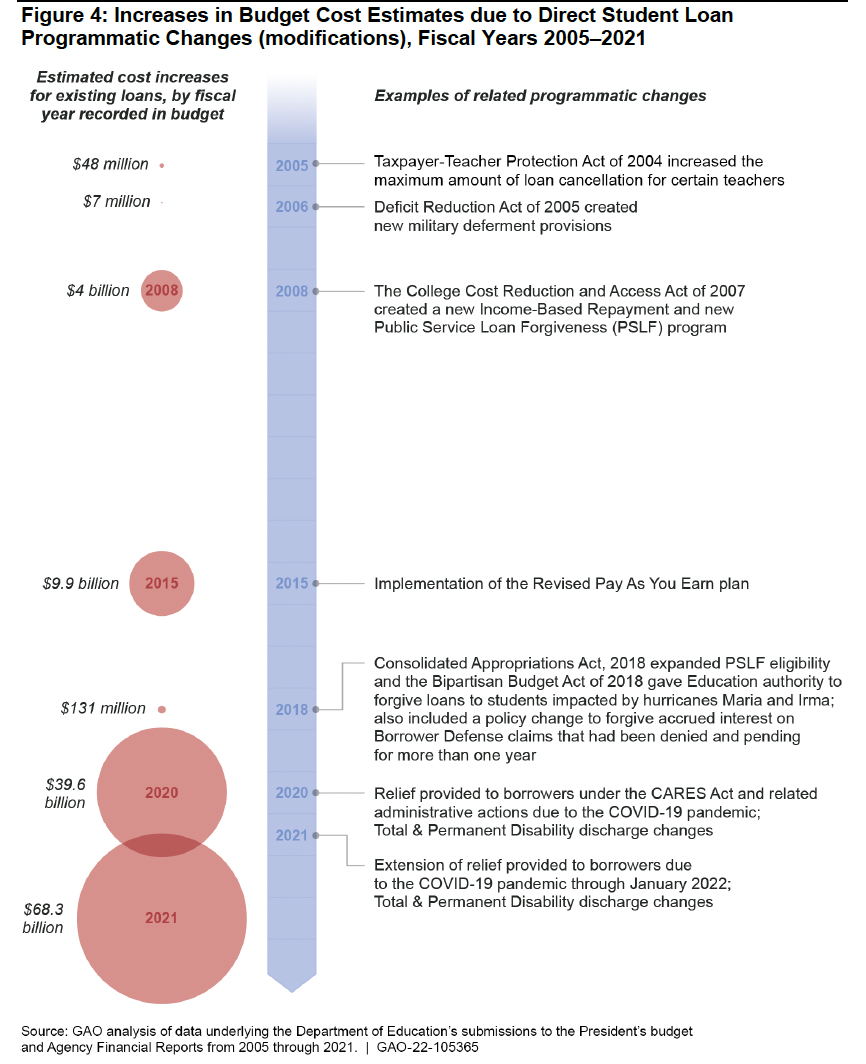

Since 1997, changes to the federal student loan program, including programs that set certain borrowers on a path toward forgiveness, new repayment methods and the pause on student loan payments that was enacted at the start of the pandemic, have driven a 33 percent increase in the cost of the student loan program, totaling $102 billion.

By far, the largest change that contributed to this increase was the pause on federal student loan payments and programmatic changes enacted throughout the pandemic and other pandemic-related loan forgiveness programs, the report shows. In total, these changes drove an increase of over $107 billion between the years 2020 and 2021.

Other changes included the Taxpayer-Teacher Protection Act of 2004, which increased the amount of loan forgiveness that certain teachers could be eligible for, resulting in a $48 million increase; the College Cost Reduction and Access Act of 2007, which re-established models for income-driven repayment (IDR) and PSLF, resulting in a $4 billion increase; and the Revised Pay as You Earn plan, a form of IDR, resulting in a $9.9 billion increase. In total, these changes have accounted for a 6 percent increase, totaling $20 billion.

Flaws in Estimates of Borrower BehaviorThe largest driver of the increase in federal student loan costs to the government was a gap in available data, the report says. Limited data available to the department to estimate how borrowers are repaying their loans, how much money borrowers are making and how many borrowers will default have driven a $189 billion increase in cost since 1997, according to the report.

The department’s inability to access data on borrowers’ income through the Internal Revenue Service has been highlighted as a key driver of internal difficulties in administering income-based repayment programs, including the possibility that Biden will cancel $10,000 in debt per borrower for those making under $150,000 a year.

Assumptions on borrowers’ repayment plan selection alone drove a $70 billion increase. One of the most common repayment plans, IDR, is especially difficult to estimate because the amount a borrower is required to pay each month changes if they have a change in their income. Almost half of federal student loans, 47 percent, are being repaid through IDR.

Additionally, changes to borrowers’ estimated income growth caused a $68 billion increase, and assumptions on how many borrowers will default caused a $23 billion increase.

Changes to the Education Department’s Budget ModelThe Education Department is currently in the process of introducing a new budget model that will be implemented in fiscal year 2026. The current model is based on estimates of large groups of borrowers, while the new model, called the microsimulation model, will take into account data from the National Student Loan Data System.

According to information provided by the department detailed in the report, this new budget model will provide more accurate predictions of changes driving cost to the federal student loan program.

Representative Robert Scott, a Democrat from Virginia and chair of the House Committee on Education and Labor, said in a statement, “Regrettably, this GAO report shows that the soaring cost of college—caused by decades of state disinvestment in higher education and the declining value of the Pell Grant—has forced students to borrow more money for a degree. Unlike previous generations, students are now taking out loans in amounts which make repayment difficult.”

* This article was originally published here

* This article was originally published here

0 comments:

Post a Comment